A comprehensive approach to managing risks over time and across key areas to protect and grow business value.

The discipline by which an organization in any industry assesses, controls, exploits, finances and monitors risks from all sources for the purpose of increasing the organization’s short and long-term value to its stakeholders. Successful ERM programs manage risk across two dimensions: Time & Space.

Well-developed ERM programs transform your approach to risk management from a short-term, once-a-year focus around traditional insurance renewals, to a long-term strategy aligned with your organization’s overall objectives.

ERM programs enhance an organization’s coverage depth, enabling formal insurance protection across three key areas of risk: Core, Operational, and Strategic.

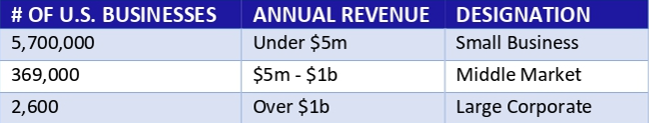

Their combination benefits everyone!

– Have limited access to credit and capital markets

– Are geographically concentrated

– Rely on narrow revenue streams

As a result, 40% of small businesses impacted by natural or human-made disasters never reopen.

Additionally,

half of those that do manage to reopen fail within two years after the disaster.

Source: Small Business Administration

The possibility of future losses or deficits arising from differences between actual outcomes and anticipated results.

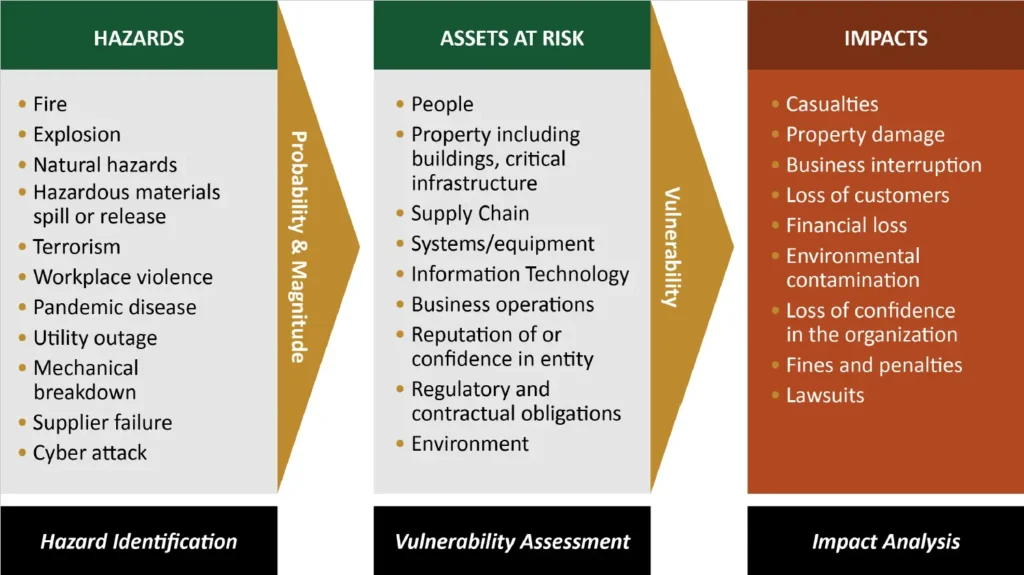

Even the U.S. Government advises small and mid-size businesses to be prepared for various potential threats. The chart below highlights potential risks and their corresponding impacts.

(Chart from Ready.gov landing page for businesses as of March 2015).